Ahmed stared at his mortgage paperwork, pen hovering over the signature line. Everything looked perfect—the house, the monthly payments, the interest rate. But that last phrase stopped him cold: interest rate.

He’d been Muslim his whole life and knew riba (interest) was haram. But he’d always figured there was no alternative. How else do you buy a house without taking a conventional loan? How do you save money without earning interest? How do you avoid the entire global financial system built on interest?

Then his friend mentioned something called “Islamic banking.” Ahmed was skeptical. “That sounds like a marketing gimmick. How can a bank operate without interest?”

Maybe you’ve had the same thought. You know Islam prohibits riba, but you’re not sure how Islamic banks actually function. Or maybe you’ve seen Islamic banking options but don’t understand what makes them different from conventional banks.

Here’s what I discovered researching Islamic finance from Shariah principles and authentic sources: Islamic banking isn’t just “regular banking with an Islamic label.” It’s a fundamentally different system based on profit-sharing, risk-sharing, and asset-backed transactions, provided they fully align with Islamic law.

This article explains exactly how Islamic banking works, what products they offer and whether Islamic banking is truly a viable alternative in modern economies.

QUICK ISLAMIC INFO BOX

What You’ll Learn:

- Why Islam prohibits interest (riba) so strictly

- The core principles that make Islamic banking different

Sources Referenced:

- Quran 2:275-279 on prohibition of riba

- Hadith on interest and ethical business practices

- Islamic finance principles and Shariah compliance

- Modern Islamic banking structures

Read Time: 9 minutes

Why Islam Prohibits Interest (Riba)

Before we get into how Islamic banking works, you need to understand why conventional interest-based banking is haram.

The Quran is absolutely clear about this:

“Those who consume interest cannot stand [on the Day of Resurrection] except as one stands who is being beaten by Satan into insanity. That is because they say, ‘Trade is [just] like interest.’ But Allah has permitted trade and has forbidden interest. So whoever has received an admonition from his Lord and desists may have what is past, and his affair rests with Allah. But whoever returns to [dealing in interest or usury]—those are the companions of the Fire; they will abide eternally therein.” (Quran 2:275)

ٱلَّذِینَ یَأۡكُلُونَ ٱلرِّبَوٰا۟ لَا یَقُومُونَ إِلَّا كَمَا یَقُومُ ٱلَّذِی یَتَخَبَّطُهُ ٱلشَّیۡطَـٰنُ مِنَ ٱلۡمَسِّۚ ذَ ٰلِكَ بِأَنَّهُمۡ قَالُوۤا۟ إِنَّمَا ٱلۡبَیۡعُ مِثۡلُ ٱلرِّبَوٰا۟ۗ وَأَحَلَّ ٱللَّهُ ٱلۡبَیۡعَ وَحَرَّمَ ٱلرِّبَوٰا۟ۚ فَمَن جَاۤءَهُۥ مَوۡعِظَةࣱ مِّن رَّبِّهِۦ فَٱنتَهَىٰ فَلَهُۥ مَا سَلَفَ وَأَمۡرُهُۥۤ إِلَى ٱللَّهِۖ وَمَنۡ عَادَ فَأُو۟لَـٰۤىِٕكَ أَصۡحَـٰبُ ٱلنَّارِۖ هُمۡ فِیهَا خَـٰلِدُونَ

Those who consume interest cannot stand [on the Day of Resurrection] except as one stands who is being beaten by Satan into insanity. That is because they say, “Trade is [just] like interest.” But Allah has permitted trade and has forbidden interest. So whoever has received an admonition from his Lord and desists may have what is past, and his affair rests with Allah. But whoever returns to [dealing in interest or usury] – those are the companions of the Fire; they will abide eternally therein.

[2:275]

And even more severely:

“O you who have believed, fear Allah and give up what remains [due to you] of interest, if you should be believers. And if you do not, then be informed of a war [against you] from Allah and His Messenger.” (Quran 2:278-279)

یَـٰۤأَیُّهَا ٱلَّذِینَ ءَامَنُوا۟ ٱتَّقُوا۟ ٱللَّهَ وَذَرُوا۟ مَا بَقِیَ مِنَ ٱلرِّبَوٰۤا۟ إِن كُنتُم مُّؤۡمِنِینَ

O you who have believed, fear Allah and give up what remains [due to you] of interest, if you should be believers.

[2:278]

Allah (SWT) declares war on those who deal in interest. That’s how serious this prohibition is.

But why? What’s wrong with interest?

Islam views interest as exploitative and unjust. When you lend money at interest, you’re guaranteed profit regardless of what happens to the borrower. If they succeed, you profit. If they fail and lose everything, you still profit. All the risk falls on the borrower while the lender earns money from money without contributing to actual economic productivity.

The Prophet Muhammad (ﷺ) said: “Gold for gold, silver for silver, wheat for wheat, barley for barley, dates for dates, and salt for salt—like for like, equal for equal, and hand to hand. If the types differ, then sell however you wish, as long as it is hand to hand.” (Sahih Muslim, Book 22, Hadith 19)

Money should be a medium of exchange, not a commodity that generates profit on its own. Islamic finance requires money to be invested in real economic activities—actual goods, services, or assets—before profit can be earned.

The Core Principles of Islamic Banking

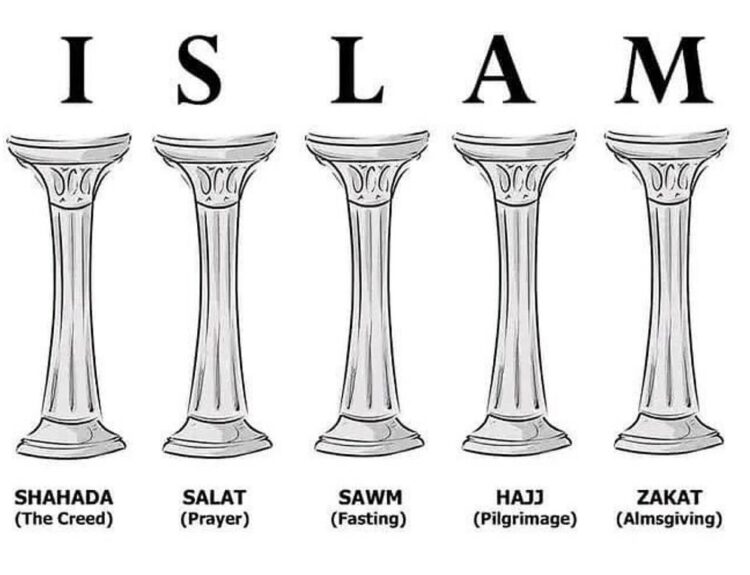

Islamic banking operates on five fundamental principles that distinguish it completely from conventional banking:

1. Prohibition of Riba (Interest)

No predetermined interest payments in any form. Banks can’t charge interest on loans, and depositors don’t earn interest on savings accounts.

2. Profit and Loss Sharing

The bank and customer share risks and rewards together. If an investment succeeds, both profit. If it fails, both share the loss proportionally. This creates partnership rather than exploitation.

3. Asset-Backed Financing

Every transaction must be backed by a tangible asset or service. You can’t make money from money alone—there must be real economic activity involved. This prevents speculation and ensures financing supports actual productivity.

4. Prohibition of Gharar (Excessive Uncertainty)

Contracts must be clear and transparent. Both parties need to fully understand what they’re getting into. Gambling, speculation, and highly uncertain transactions are prohibited.

5. Ethical Investment Only

Islamic banks won’t finance anything haram—no alcohol, tobacco, gambling, weapons, pork, or interest-based financial services. Your money only supports halal businesses.

These principles create a financial system focused on fairness, transparency, and real economic productivity rather than profit maximization through exploitation.

The Severity of Riba Cannot Be Overstated

Before you proceed with any Islamic banking product, understand the gravity of what’s at stake. Allah (SWT) doesn’t merely prohibit riba (interest)—He declares war against those who engage in it:

“O you who have believed, fear Allah and give up what remains [due to you] of interest, if you should be believers. And if you do not, then be informed of a war [against you] from Allah and His Messenger.” (Quran 2:278-279)

فَإِن لَّمۡ تَفۡعَلُوا۟ فَأۡذَنُوا۟ بِحَرۡبࣲ مِّنَ ٱللَّهِ وَرَسُولِهِۦۖ وَإِن تُبۡتُمۡ فَلَكُمۡ رُءُوسُ أَمۡوَ ٰلِكُمۡ لَا تَظۡلِمُونَ وَلَا تُظۡلَمُونَ

And if you do not, then be informed of a war [against you] from Allah and His Messenger. But if you repent, you may have your principal – [thus] you do no wrong, nor are you wronged.

[2:279]

Read that again. A war from Allah (SWT) and His Messenger (ﷺ). Not just a sin. Not just something discouraged. An actual declaration of divine war against you.

The Prophet Muhammad (ﷺ) said: “Riba has seventy segments, the least serious being equivalent to a man committing adultery with his own mother.” (Sunan Ibn Majah, Book 12, Hadith 2274, authenticated)

The least serious form of riba equals one of the most heinous sins imaginable. That’s the magnitude of what you’re dealing with.

Not All “Islamic Banking” Products Are Created Equal

Here’s the uncomfortable truth: some Islamic banking products operate in gray areas where scholars genuinely disagree about their permissibility. Products like Tawarruq (commodity murabaha), certain “Islamic” credit cards, and some complex financing structures have been criticized by respected scholars as being too similar to conventional interest-based banking.

You cannot afford to gamble with your Akhirah (Hereafter).

What good is owning a house, a car, or any worldly possession if you’re earning Allah’s (SWT) anger through doubtful transactions? What profit is there in convenience if it costs you Paradise?

The Prophet (ﷺ) taught us: “Leave what makes you doubt for what does not make you doubt.” (Sunan al-Tirmidhi, Book 27, Hadith 2518, authenticated as hasan sahih)

If you have any doubt whether an Islamic banking product is truly Shariah-compliant, you must stop and seek clarity before proceeding.

You MUST Consult Qualified Scholars Before Proceeding

This article provides general educational information—it is not a fatwa (religious ruling) for your specific situation. Islamic finance is complex, and not all scholars agree on every product’s permissibility.

Before you sign any Islamic banking contract, you are strongly advised to:

1. Consult a qualified Islamic scholar who has:

- Deep knowledge of Islamic jurisprudence (fiqh), particularly financial transactions

- Understanding of modern banking structures

- Authority to issue fatwas based on recognized scholarly credentials

- No financial interest in the bank whose products you’re evaluating

2. Get written Shariah board approval from the Islamic bank showing that qualified scholars have reviewed and approved the specific product you’re considering.

3. Verify the scholar’s credentials. Not every “Islamic consultant” at a bank is a qualified scholar. Ask about their Islamic education, which scholars they studied under, and what authority they have to declare something halal or haram.

4. Get a second opinion if possible, especially for large transactions like home financing. Major financial decisions deserve thorough due diligence.

5. Ask specific questions:

- “How exactly does this product differ from conventional interest?”

- “Which classical Islamic rulings justify this structure?”

- “Are there any scholars who consider this product doubtful or impermissible?”

- “What happens if the asset backing this financing is destroyed—who bears the loss?”

The Akhirah is Forever—This Dunya is Temporary

You might spend 20-30 years paying off an Islamic home financing contract. But your Akhirah is eternal.

Is saving money on rent worth potentially earning Allah’s (SWT) wrath? Is the convenience of a “slightly questionable” Islamic banking product worth risking your standing before your Creator on the Day of Judgment?

The Prophet (ﷺ) warned: “A time will come upon the people when they will not care about how they earn money, whether lawfully or unlawfully.” (Sahih Bukhari, Book 34, Hadith 51)

Don’t be among those people. Care deeply about the source of your wealth and the methods you use to acquire it.

When in Doubt, Choose Caution Over Convenience

If you cannot find truly halal Islamic banking options in your area, or if the available products seem questionable, consider alternatives:

- Save and buy with cash when possible (yes, it takes longer, but your earnings remain pure)

- Rent instead of buying if home financing seems doubtful

- Delay major purchases until you find genuinely halal financing

- Relocate if necessary to areas where authentic Islamic banking is available

- Accept less convenience in exchange for certainty that your wealth is halal

Remember: countless Muslims throughout history lived without conventional banking or “Islamic” alternatives. They prioritized halal earnings over worldly comfort. If they could do it, so can you.

The Bottom Line

Islamic banking can be a valid solution—when done correctly by institutions that genuinely follow Shariah principles. But the burden is on you to verify this before proceeding.

Do not assume a product is halal just because it’s marketed as “Islamic.” Do not proceed with transactions that make you uncomfortable spiritually. Do not prioritize worldly gain over your relationship with Allah (SWT).

Consult qualified scholars. Verify Shariah compliance thoroughly. When in doubt, walk away.

Your Akhirah is not worth risking for a house, a car, or any amount of worldly convenience. Period.

May Allah (SWT) protect us from riba, guide us to purely halal earnings, and grant us the wisdom to prioritize our Hereafter over temporary worldly benefits. May He make us among those who fear His warnings and avoid His prohibitions. Ameen.

For specific questions about whether a particular Islamic banking product is Shariah-compliant, consult qualified scholars or your bank’s Shariah board.